Ga payroll calculator 2023

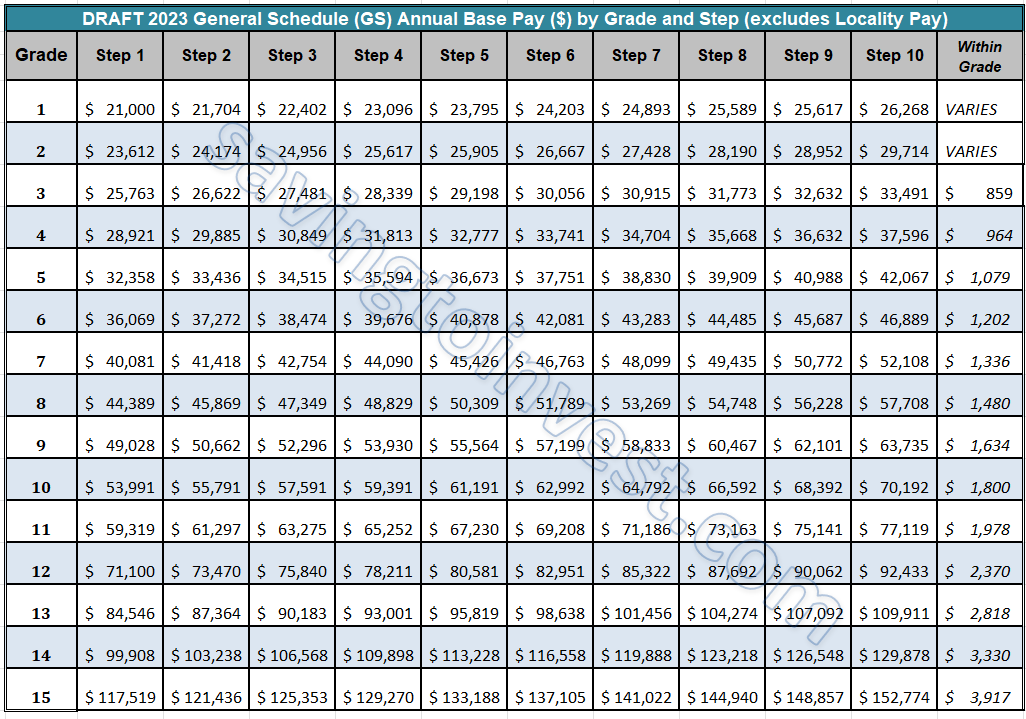

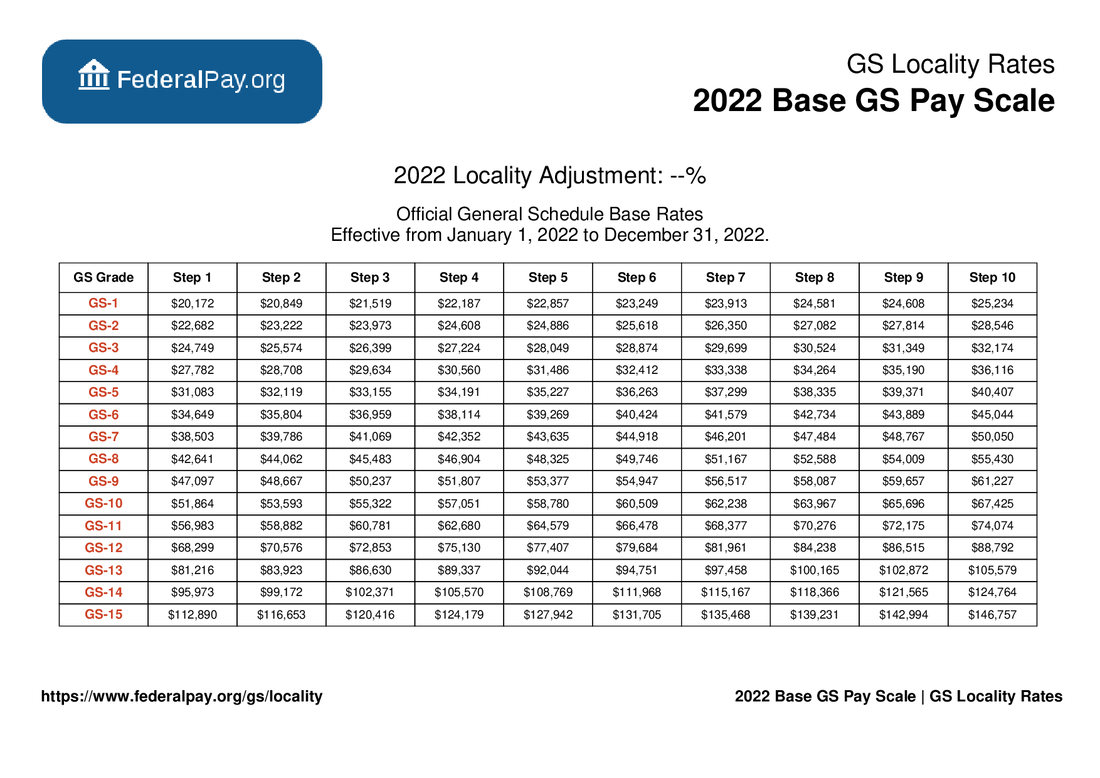

The yearly base salaries of General Schedule employees in Atlanta can be determined from the 2022 pay chart below based on their GS Grade and Step. Outlook for the 2023 Georgia income tax rate is to.

Federal Register Medicare Program Calendar Year Cy 2023 Home Health Prospective Payment System Rate Update Home Health Quality Reporting Program Requirements Home Health Value Based Purchasing Expanded Model Requirements And Home Infusion

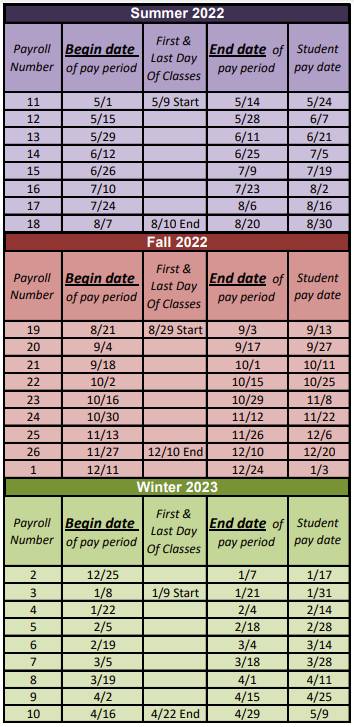

2023 Payroll Calendar PDF - 163 KB 11042021.

. Simply enter their federal and state W-4 information as. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator. For example if an employee earns 1500.

Get a head start on your next return. Local state and federal government websites often end in gov. Regarding the pay rates this calculator produces for grades GS-1 through GS-4 for locations within the United States please be aware that beginning on the first day of the first applicable.

Georgia Payroll Taxes With six different tax brackets payroll in Georgia is especially progressive meaning the more your employees make the more they have to pay. Georgia Payroll Calculator Tax Rates Use our easy payroll tax calculator to quickly run payroll in Georgia or look up 2021 state tax. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Georgia.

An official website of the United States government. Georgia Paycheck Calculator Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Georgia annualmonthly salary schedule for 10 months employment base equals school year level of certification salary step t-1 t-2 bt-4 t-4 bt-5 t-5 bt-6 bt-7 t-7 fy22 initial years.

Employers can enter an. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Begin tax planning using the 2023 Return Calculator below.

Kentucky paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. Skip to main content. Payroll calendars are available for download and print.

ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

FAQ Blog Calculators Students Logbook. With 123PayStubs you can create professional pay stubs for your employees with accurate tax calculations including SUTA taxes at the lowest price 399 in the industry. Just enter the wages tax withholdings and.

Figure out your filing status work out your adjusted gross income. Sign up for a free Taxpert account and e-file your returns each year they are due. For more details learn more about.

How to calculate annual income. Deadline Calendars 2021 - 2022 Smart HR 2022 - 2023 Smart HR Calculator GO to Calculator Stipend Listings 2021 - 2022 2022 - 2023 2023 - 2024 2024 - 2025 2025 - 2026.

Pay Periods And Pay Dates Student Employment Grand Valley State University

Salary Tax Calculator 2022 23 Pakistan Income Tax Slabs 2022 23

Federal Register Medicare Program Fy 2023 Hospice Wage Index And Payment Rate Update And Hospice Quality Reporting Requirements

Federal Register Medicare Program Calendar Year Cy 2023 Home Health Prospective Payment System Rate Update Home Health Quality Reporting Program Requirements Home Health Value Based Purchasing Expanded Model Requirements And Home Infusion

Lawmakers Push For 5 1 2023 Federal Pay Raise Fedsmith Com

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Federal Register Medicare Program Fy 2023 Hospice Wage Index And Payment Rate Update And Hospice Quality Reporting Requirements

Estimated Income Tax Payments For 2023 And 2024 Pay Online

Calculator And Estimator For 2023 Returns W 4 During 2022

When Are Taxes Due In 2022 Forbes Advisor

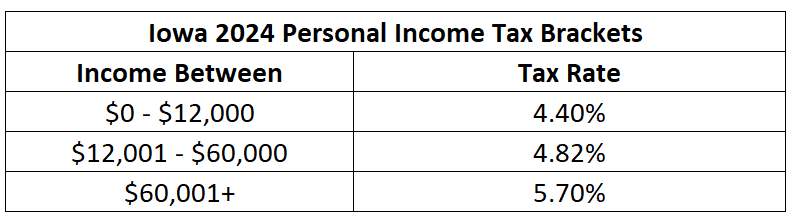

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Georgia State University Holidays 2020 Georgia State University Georgia State State University

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

2

General Schedule Gs Base Pay Scale For 2022

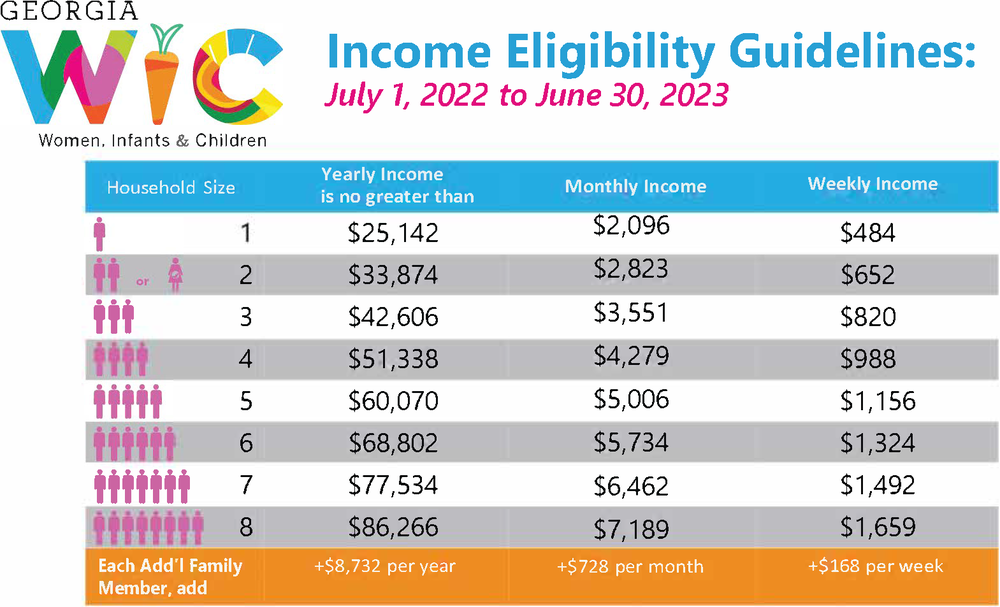

Eligibility Income Guidelines Georgia Department Of Public Health

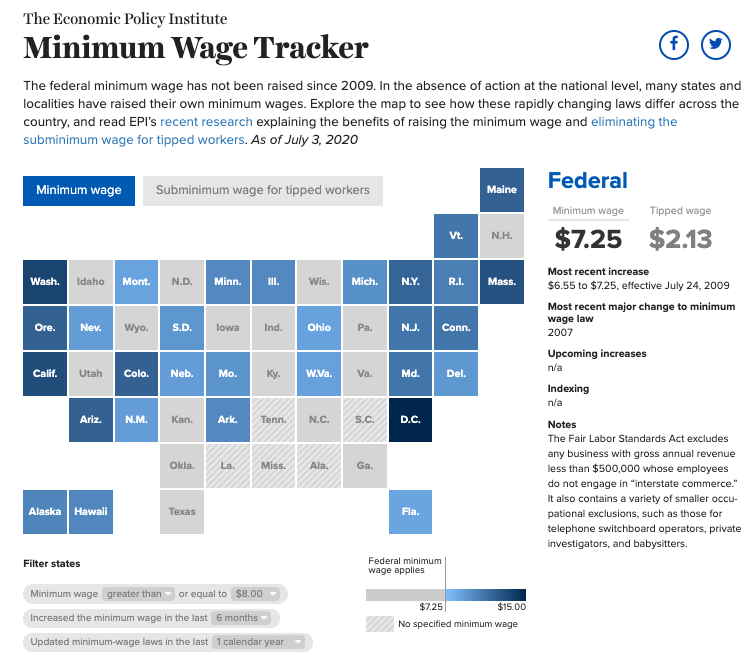

Minimum Wage Tracker Economic Policy Institute